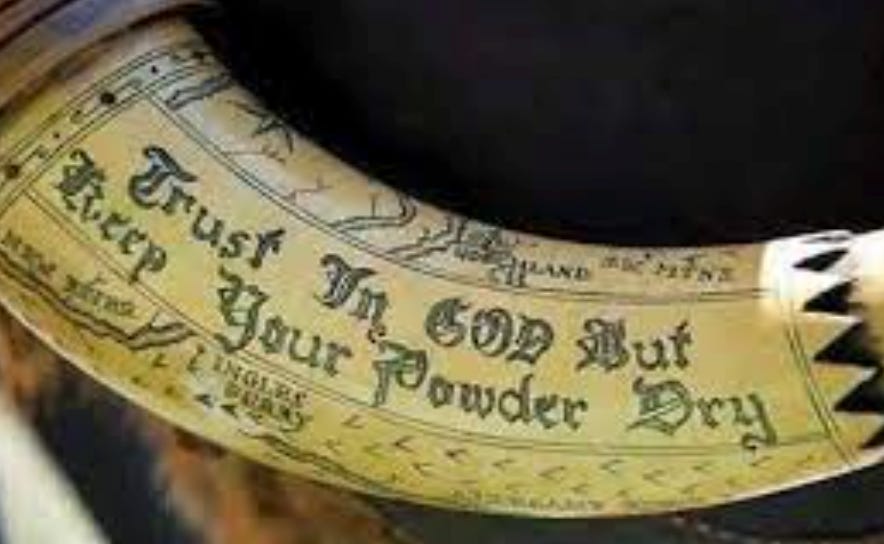

Dry Powder

I hate the term. I really do. But maybe philanthropists and foundations need to deploy some dry powder of their own.

A few weeks ago my wife and I were out for dinner, seated in a row of symmetrical two-tops, nestled cozily between other dining duos. When in dining situations like this, our approach is to lower our voices such that our spousal conversations remain private but also loud enough so that we can actually hear each other’s sentences.

Sadly that’s not everyone’s approach.

Because the gentleman seated next to us was presenting ideas on medical technology to his dining companion in a booming falsetto, like some kind of superhuman megaphone. He was so loud that the coat check attendant ordered one of his MRI machines.

All kidding aside, what struck me about this person’s presentation, aside from the seismic event emanating from his pie hole, is how many times he used the phrase “dry powder”. His investors had dry powder. His Private Equity friends had dry powder. His firm had dry powder. And better yet, the coming global financial crisis is creating “lower multiples“ and “Greenfield investment opportunities“ for deploying a lot - like a real lot - of this mysterious “dry powder”.

Of course, “dry powder” is investment capital held by investment firms, rich individuals or sovereign wealth funds. They hold this “dry powder” in abeyance until appropriate investment opportunities present themselves. In this case, the gentleman was enthusiastic about his access to dry powder, because he was - or at least he thought he was - representing an investment opportunity worthy of - uh - moistening the powder.

Wait, that makes no sense. Oh well, you get the idea.

This idea of “dry powder” waiting on the sidelines for appropriate money-making opportunities has been bothering me since that dinner. The idea of that extremely wealthy individuals - private equity managers, investment fund managers, and the like - who’ve amassed huge sums of money are just sitting around waiting to make investments - but only when the time is perfect. Maybe they’re waiting for global economic conditions to sufficiently deteriorate, or for the business owner to see no other choice but to sell - and for presumably a reduced price. Maybe there need to be more layoffs, more misery, and more lives ruined before getting the ol’ powder wet?

OK OK, fine I get it. Of course, investors buy low and sell high. That is what they do. And while I don’t want to hear about it while I’m having dinner with my wife (and wouldn’t buy whatever that dude was selling) the idea of dry powder is an investment concept that I completely and totally understand.

So what does dry powder have to do with a blog about Philanthropy?

Well, maybe the philanthropic world should start to think about dry powder in the same way. Foundations are required to give a minimum distribution every year, and most of them stick to that framework. They don’t suddenly double or triple giving when times are tough, or when society’s issues double or triple or even quintuple in magnitude.

They tend to mostly stay within the boundaries of an extremely conservative - and federally mandated - giving framework.

But what if foundations and other philanthropists thought more like private equity investors? No, not like sharks trying to kill each other. Rather, what if they approached philanthropic decisions with their own version of dry powder? I would argue and have argued many times, that the donor-advised fund is a massive pile of dry powder. And any Foundation funded by big tech in the last 30 years is basically undeployed, untaxed social capital that should be aggressively circulated back into the system that enabled these extreme fortunes.

And of course, there are the legacy foundations, Ford, MacArthur, etc., who sit on enormous sums of money, and yet… those funds are simply assets under management, not dry powder that can be deployed against society’s grandest challenges.

So if you’re in a position to do so, ask philanthropists and foundations about their “dry powder”. I’d be curious how they might respond.

I’m on my way to a donor meeting. Can’t wait to find a way to use the phrase “dry powder”!

Hello My name is Bonnie and I work in Guatemala with a non profit that provides survivor services to labor trafficked children in agriculture. We currently have a vanilla bean farm in Guatemala with an annual harvest of 500kg. I would like to talk with you and offer a partnership.